Simulated trading serves as a vital training ground for aspiring investors, yet it is not without its shortcomings. Many traders flock to these virtual platforms, lured by the promise of risk-free experimentation.

However, beneath this enticing facade lies a series of substantial limitations that can significantly skew ones trading acumen. From the detachment of emotion in a simulated environment to the unrealistic conditions that fail to replicate market volatility, traders often find themselves ill-prepared when facing real-world scenarios.

To navigate these pitfalls and enhance their trading skills, it becomes essential to identify and understand these limitations. Equipping oneself with strategies to transcend them can transform simulated experiences into more meaningful insights—ultimately bridging the chasm between theoretical knowledge and practical proficiency.

In this article, we will delve into the most pressing constraints of simulated trading and explore actionable solutions to turn these challenges into opportunities for growth.

Unrealistic Market Conditions

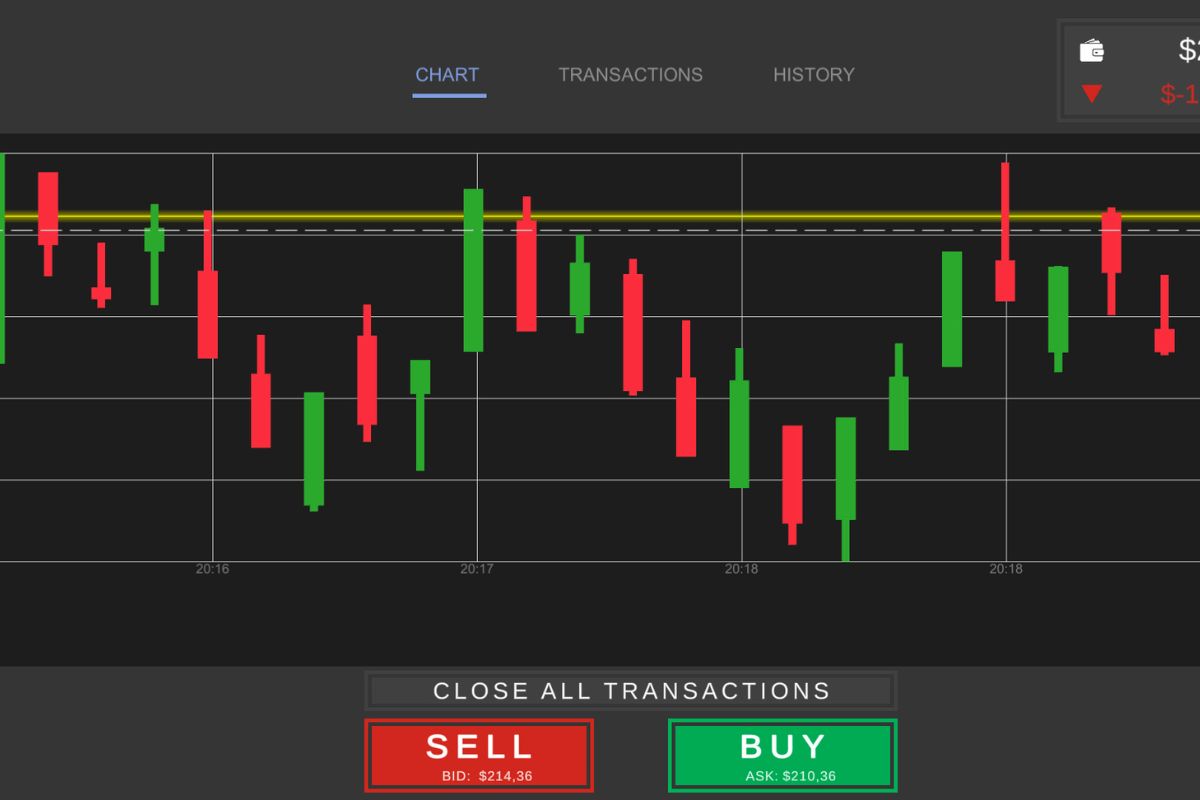

Unrealistic market conditions can significantly undermine the effectiveness of simulated trading, creating a chasm between practice and real-world scenarios. In many simulations, traders encounter overly idealized environments where market volatility is limited and the influence of unexpected events is nearly nonexistent.

These conditions foster a false sense of security, leading traders to develop strategies that might flourish in a controlled setting but falter in the unpredictable chaos of actual markets. For instance, the absence of slippage, liquidity issues, or emotional responses to losses can warp a trader\’s understanding of risk management and decision-making.

Utilizing tools like depth of market software can help bridge this gap by simulating real-time order book dynamics, providing a clearer picture of market liquidity and execution challenges. DOM software highlights the interplay between supply and demand at different price levels, allowing traders to anticipate potential bottlenecks or slippage during high-stakes trades.

To further enhance realism, simulations should also introduce elements like sudden market shifts, varied liquidity conditions, and simulated news events, creating a more authentic trading experience. By confronting the true nature of markets through tools like depth of market software, traders can refine their instincts and strategies, preparing them to navigate the complexities and challenges they will inevitably face.

Incomplete Risk Management Practices

Incomplete risk management practices are a significant shortcoming in the realm of simulated trading, often leaving participants woefully unprepared for the unpredictability of real markets. Traders may become engrossed in the thrill of market simulations, dazzled by sudden gains or temporary downturns, yet overlook the critical nuances of risk assessment.

This oversight can foster a false sense of security; participants might neglect to develop robust strategies that account for potential pitfall scenarios, which can lead to catastrophic losses once they transition to actual trading. Moreover, the simplicity of many simulated environments fails to replicate the complexities inherent to genuine trading landscapes, such as slippage, liquidity issues, and emotional stress. Consequently, without a solid framework for risk management that encompasses a variety of market conditions and personal biases, traders are at risk of encountering rude awakenings when faced with the realities of live trading.

This gap underscores the urgent need for incorporating comprehensive risk management protocols into simulated trading practices to foster a more realistic and educational experience.

Conclusion

In conclusion, while simulated trading offers a valuable platform for honing skills and testing strategies, it is essential to acknowledge its inherent limitations, such as the lack of emotional engagement and real-world market dynamics. Traders must recognize that without the pressure and unpredictability of actual trading, lessons learned in simulations may not always translate to success in live environments.

To bridge this gap, integrating advanced tools like depth of market software can provide a more nuanced understanding of market behavior and enhance decision-making processes. By complementing simulated trading with the use of sophisticated market analysis tools and a pragmatic approach to risk management, traders can better prepare themselves for the challenges of real-world trading, ultimately leading to greater success in their financial endeavors.